Representation: Natalia Agatte

This newsletter was once featured in One Nice Tale, New York’s studying advice e-newsletter. Join right here to get it nightly.

The boat was once a wonderful thing about a factor: some 500 heaps throughout 171 ft of glass and metal as white as Santorini. All rounded edges, the 5 decks — one with a glass-bottom pool — had been made for July at the Mediterranean, sundown dinners some of the islands close to Sicily, cocktails within the turquoise shallows off the coast of Ibiza. Her would-be captains confirmed off photos of the $50 million vessel at events, bragging that it could be “larger than the entire richest billionaires’ yachts in Singapore” and describing plans to beautify the staterooms with projector displays, making a waterborne gallery for his or her rising selection of virtual artwork within the type of NFTs.

Regardless of that that they had at the beginning advised buddies they had been purchasing for a $150 million vessel; the superyacht was once nonetheless the biggest via well-established boat builder Sanlorenzo ever to be bought in Asia, a triumph of crypto’s nouveau riche. “It represents the start of an interesting adventure,” the yacht dealer stated in a press release of the sale final yr, announcing it regarded “ahead to witnessing many satisfied moments aboard.” The title the consumers had in thoughts was once cleverly selected — an within comic story nodding to the cryptocurrency dogecoin that might each thrill their social-media acolytes and be intelligible to the entire pathetic, deficient “no coiners” in the market: A lot Wow.

Her consumers, Su Zhu and Kyle Davies, two Andover graduates who ran a Singapore-based crypto hedge fund known as 3 Arrows Capital, by no means were given the danger to spray Champagne throughout A lot Wow’s bow. As a substitute, in July, the similar month the boat was once set to release, the duo filed for chapter and disappeared sooner than making their ultimate fee, marooning the unclaimed trophy in her berth in L. a. Spezia at the Italian coast. Whilst she has no longer been formally indexed for resale, the intimate international of world super-yacht sellers has quietly been placed on realize {that a} positive Sanlorenzo 52Steel, the coveted Cayman Islands flag billowing above her empty balconies, is again in the marketplace.

The yacht has since change into the topic of never-ending memes and jokes on Twitter, the purposeful middle of the crypto universe. Just about everybody in that international, from the tens of millions of small-scale crypto holders to trade staff and traders, has watched in surprise and dismay as 3 Arrows Capital, as soon as most likely essentially the most very popular funding fund in a burgeoning world monetary sector, collapsed in excruciating and embarrassing type. The company’s implosion, a results of each recklessness and most probably prison misconduct, prompt a contagion that no longer simplest pressured a ancient sell-off in bitcoin and its ilk but in addition burnt up a large swath of the cryptocurrency trade.

Crypto firms from New York to Singapore had been the direct sufferers of 3 Arrows. Voyager Virtual, a publicly traded crypto substitute founded in New York that when had a multibillion-dollar valuation, filed for Bankruptcy 11 in July, reporting that 3 Arrows owed it greater than $650 million. Genesis International Buying and selling, headquartered on Park Street, had lent 3 Arrows $2.3 billion. Blockchain.com, an early crypto corporate that equipped virtual wallets and developed into a significant substitute, faces $270 million in unpaid loans from 3AC and has laid off 1 / 4 of its team of workers.

Amongst crypto’s smartest observers, there’s a broadly held view that 3 Arrows is meaningfully accountable for the bigger crypto crash of 2022, as marketplace chaos and compelled promoting despatched bitcoin and different virtual property plunging 70 p.c or extra, erasing greater than one thousand billion greenbacks in price. “I believe they could be 80 p.c of the overall unique contagion,” says Sam Bankman-Fried, who as CEO of FTX, a significant crypto substitute that has bailed out one of the bankrupt lenders, has most likely extra visibility at the issues than any individual. “They weren’t the one individuals who blew out, however they did it means larger than any individual else did. They usually had far more accept as true with from the ecosystem previous to that.”

For a company that had at all times portrayed itself as taking part in simply with its personal cash — “We don’t have any exterior traders,” Zhu, 3AC’s CEO, had advised Bloomberg as lately as February — the wear and tear 3 Arrows led to was once astonishing. By means of mid-July, collectors had come ahead with greater than $2.8 billion in claims; the determine is anticipated to balloon from there. Everybody in crypto, from the biggest lenders to rich traders, gave the impression to have lent 3AC their virtual cash, even 3AC’s personal staff, who deposited their salaries with its “borrowing table” in substitute for hobby. “Such a lot of other people really feel disillusioned and a few of them embarrassed,” says Alex Svanevik, the CEO of Nansen, a Singapore-based blockchain-analytics corporate. “They usually shouldn’t as a result of a large number of other people fell for this, and a large number of other people gave them cash.”

That cash seems to be long past now, at the side of the property of a number of affiliated price range and parts of the treasuries of more than a few crypto initiatives 3AC had controlled. The real scale of the losses would possibly by no means be identified; for lots of the crypto start-ups that parked their cash with the company, disclosing that courting publicly is to menace greater scrutiny from each their traders and govt regulators. (Because of this, at the side of the felony complexities of being a creditor, many of us who spoke about their reports with 3AC have requested to stay nameless.)

In the meantime, the unclaimed yacht looms as a relatively ridiculous avatar of the hubris, greed, and recklessness of the company’s 35-year-old co-founders. With their hedge fund in the course of chaotic liquidation complaints, Zhu and Davies are lately believed to be in hiding. (More than one emails to them and their attorneys asking for remark went unreturned, with the exception of for an automated answer from Davies that reads, “Please be aware I’m out of place of business at the moment.”) For an trade continuously protecting itself in opposition to accusations that cryptocurrency is, at its center, a rip-off, 3 Arrows gave the impression to end up the antagonists’ level.

Zhu and Davies are two bold younger males, via all descriptions exceedingly sensible, who seemed to perceive the structural alternative of virtual forex somewhat effectively: that crypto is a recreation of making digital fortunes out of skinny air and convincing different people with conventional kinds of cash that the ones digital fortunes should be real-world ones. They constructed social-media cred via taking part in the a part of billionaire monetary geniuses, translated that to exact monetary credit score, then put billions of greenbacks in borrowed cash to paintings in speculative investments they may cheerlead to luck with their huge, influential platforms. Sooner than you are aware of it, the faux billionaire is an actual billionaire purchasing for super-yachts. They grokked the sport, and the plan labored completely — till it didn’t.

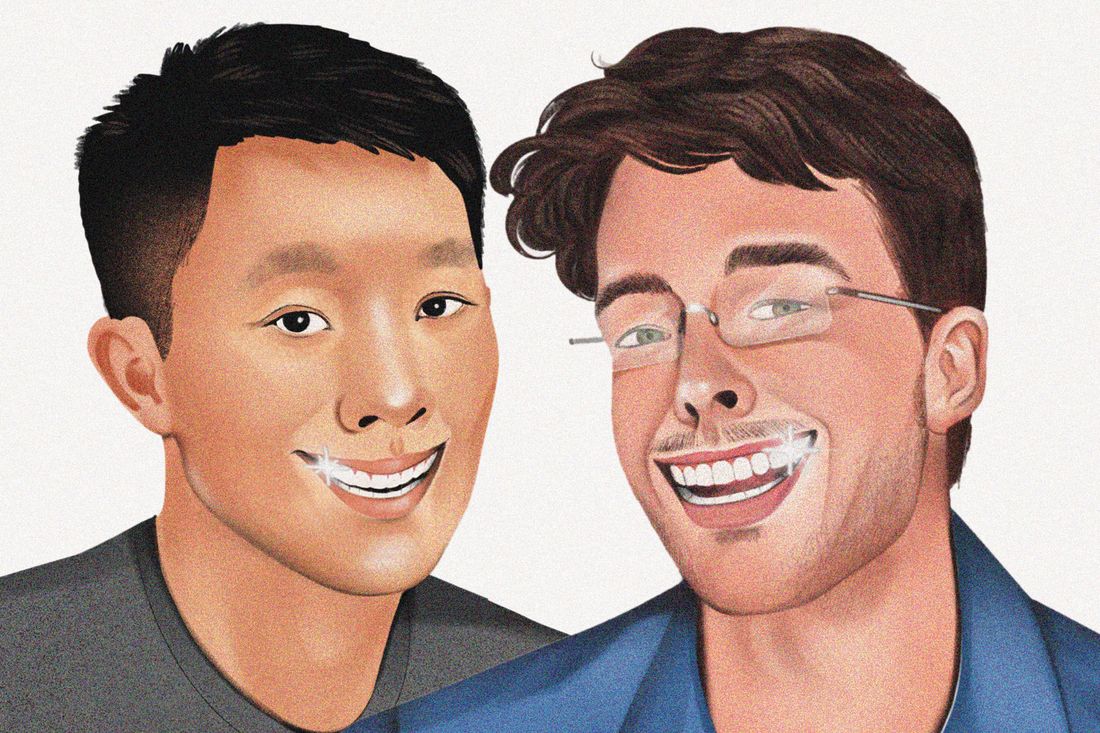

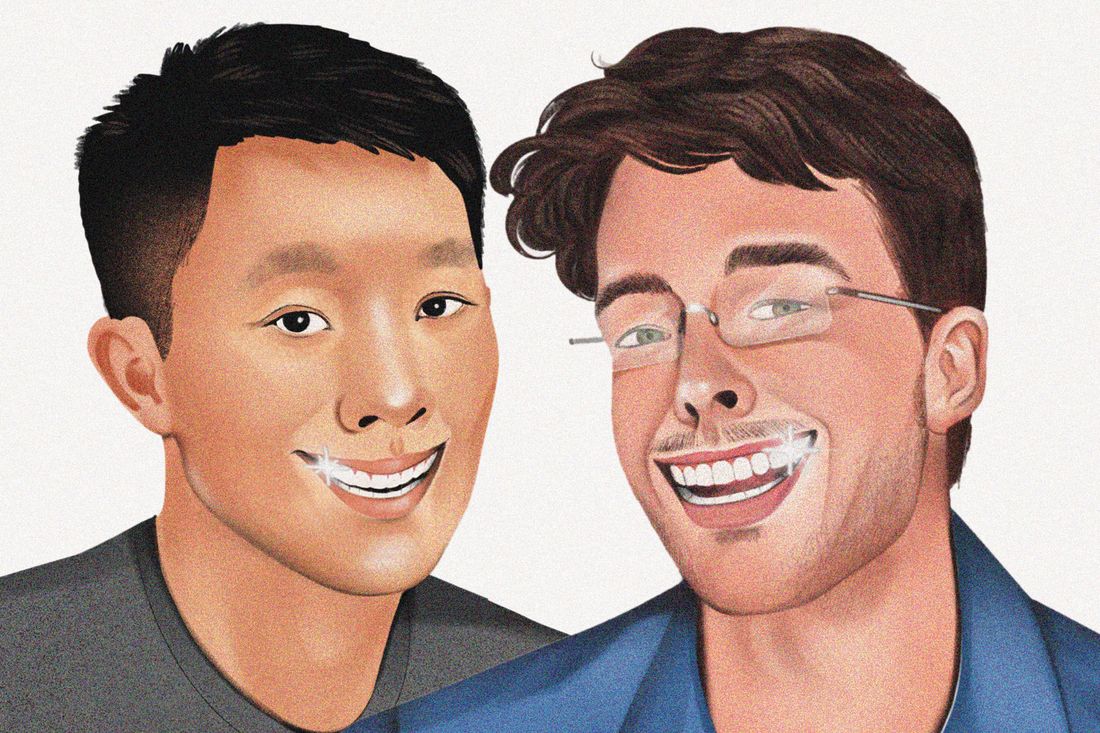

Zhu and Davies of their senior yr at Andover in 2005. Photograph: Phillips Academy.

Zhu and Davies of their senior yr at Andover in 2005. Photograph: Phillips Academy.

Su Zhu and Kyle Davies met at Phillips Academy in Andover, Massachusetts, a part of the category that began highschool the similar week as 9/11. Whilst a lot of children at Andover, because the top-ranked boarding faculty is often identified, come from nice wealth or distinguished households, Zhu and Davies grew up in somewhat modest cases within the Boston suburbs. “Either one of our oldsters aren’t, like, wealthy,” Davies stated in an interview final yr. “We’re very a lot middle-class guys.” Neither had been they particularly standard. “They had been each referred to as roughly bizarre, however Su particularly,” says a classmate. “Actually, they weren’t bizarre in any respect — simply shy.”

Zhu, a Chinese language immigrant who had come to the U.S. together with his circle of relatives when he was once 6, was once identified for his best possible GPA and for taking a heroic load of AP categories; he won the “maximum studious” superlative in his senior yearbook. He earned a different quotation for his paintings in math, however he was once some distance from only a numbers man — he was once additionally awarded Andover’s peak prize for fiction upon commencement. “Su was once the neatest individual in our category,” recalls a fellow pupil.

Davies was once a celebrity at the staff staff, however classmates in a different way be mindful him as an intruder — in the event that they be mindful him in any respect. A budding Japanophile, Davies won peak honors at commencement in Jap. In line with Davies, he and Zhu weren’t in particular shut again then. “We went to highschool in combination, we went to school in combination, and we were given our first task in combination. We weren’t the most efficient of buddies right through, he stated on a crypto podcast in 2021. “I didn’t know him that effectively in highschool. I knew he was once a sensible man — he was once like valedictorian of our category — however via school we began to hang around much more.”

“Faculty in combination” was once at Columbia, the place they each took a math-heavy courseload and joined the squash staff. Zhu graduated a yr early, summa cum laude, and moved to Tokyo to industry derivatives at Credit score Suisse, the place Davies adopted him as an intern. They’d desks subsequent to one another till Zhu was once laid off within the monetary disaster, touchdown at a high-frequency buying and selling store in Singapore known as Go with the flow Investors.

It was once there that Zhu realized the artwork of arbitrage — making an attempt to seize small diversifications in relative price between two related property, generally promoting the person who’s overpriced and purchasing the person who’s underpriced. He eager about exchange-traded price range (mainly mutual price range which might be indexed like shares), buying and selling out and in of comparable ones to assemble small earnings. He excelled at it, emerging to the end percentile of moneymakers at Go with the flow. The luck gave him a brand new self assurance. He was once identified to bluntly criticize colleagues’ efficiency or even name out his bosses. Zhu stood out in in a different way: The Go with the flow workplaces, stuffed with servers, ran sizzling, and he would come to paintings in short-shorts and a T-shirt, then take away the blouse, leaving it off even if he went in the course of the construction’s foyer. “Su can be strolling round topless in his mini-shorts,” a former colleague recollects. “He was once the one person who’d take off his blouse and industry.”

After Go with the flow, Zhu did a stint at Deutsche Financial institution, following within the footsteps of Arthur Hayes, the crypto legend and billionaire co-founder of the BitMEX substitute. Davies had stayed on at Credit score Suisse, however via then each had been tiring of the big-bank existence. Zhu complained to acquaintances in regards to the low caliber of his banking colleagues and a bloated tradition that allowed other people to lose the company’s cash on a industry with little outcome; in his view, the most efficient ability had already decamped for hedge price range or struck out on their very own. He and Davies, now 24 years previous, made up our minds to start out their very own store. “There was once little or no drawback to leaving,” Davies defined within the interview final yr. “Like, if we ever left and in point of fact messed it up onerous, we’d surely get some other task.”

In 2012, whilst each had been briefly dwelling in San Francisco, Zhu and Davies pooled their financial savings and borrowed cash from their oldsters to scrape in combination about $1 million in seed price range for 3 Arrows Capital. The title got here from a Jap legend during which a prominent daimyo, or warlord, teaches his sons the adaptation between looking to snap a unmarried arrow — easy — and looking to ruin 3 arrows in combination — not possible.

In lower than two months, that they had doubled their cash, Davies stated at the podcast UpOnly. The pair quickly headed for Singapore, which has no capital-gains tax, and via 2013, they’d registered the fund there with plans to relinquish their U.S. passports and change into electorate. Zhu, fluent in Chinese language and English, moved fluidly within the Singapore social scene, now and again website hosting poker video games with Davies and pleasant exhibition chess fits. They appeared pissed off via their lack of ability to get 3 Arrows to the following degree, despite the fact that. At a dinner round 2015, Davies lamented to some other dealer about how onerous it was once to boost cash from traders. The dealer wasn’t stunned — in spite of everything, Zhu and Davies had neither a lot of a pedigree nor a monitor document.

Throughout this early segment, 3 Arrows Capital eager about a distinct segment marketplace: arbitraging emerging-market foreign-exchange (or “FX”) derivatives — monetary merchandise tied to the longer term worth of smaller currencies (the Thai baht or the Indonesian rupiah, as an example). Get entry to to these markets is dependent upon having stable buying and selling relationships with large banks, and getting within the door was once “virtually not possible,” BitMEX’s Hayes wrote lately in a Medium publish. “When Su and Kyle advised me how they were given began, I used to be beautiful inspired that they had hustled their means into this profitable marketplace.”

On the time, FX buying and selling was once shifting to digital platforms, and it was once simple to search out variations, or spreads, between the costs quoted at other banks. 3 Arrows discovered its candy spot trolling the listings for mispricings and “choosing them off,” as Wall Boulevard calls it, continuously pocketing simply fractions of a cent on each and every greenback traded. It was once a technique the banks detested — Zhu and Davies had been necessarily scooping up cash those establishments would in a different way stay. From time to time, when banks discovered they’d quoted 3 Arrows the incorrect worth, they might ask to amend or cancel the industry, however Zhu and Davies wouldn’t budge. Remaining yr, Zhu tweeted out a 2012 photograph of himself smiling whilst sitting in entrance of eleven displays. Apparently creating a connection with their FX-trading means of choosing off banks’ bids, he wrote, “You haven’t lived till you’ve hit 5 sellers at the similar quote at 230am.”

By means of 2017, the banks started slicing them off. “Every time 3 Arrows asked a worth, the entire financial institution FX buyers had been like, ‘Fuck those guys, I’m no longer going to value them,’ ” says a former dealer who was once a counterparty to 3AC. In recent years, a comic story has been going round amongst FX buyers who knew 3 Arrows in its early days and watched it cave in with a bit of of Schadenfreude. “We FX buyers are in part in charge for this as a result of we knew for a undeniable fact that those guys weren’t in a position to earn a living in FX,” says the previous dealer. “However then after they got here to crypto, everybody idea they had been geniuses.”

On Might 5, 2021, with 3 Arrows on the peak of its fortunes, Zhu tweeted a 2012 photograph of the company in its earliest days, when he and Davies traded foreign exchange out of a two-bedroom rental. Implicit within the tweet was once a message: Suppose how nice we will have to be to have constructed a multibillion-dollar company from such humble beginnings.

Photograph: Su Zhu/Twitter

A elementary factor to learn about crypto is that, up to now anyway, it’s been matter to a development of utmost however more or less common boom-and-bust cycles. Within the 13-year historical past of bitcoin, the 2018 undergo marketplace was once a in particular painful one. After attaining a document excessive of $20,000 in past due 2017, the cryptocurrency crashed to $3,000, dragging with it 1000’s of smaller cash available in the market. It was once in contrast backdrop that 3 Arrows switched its center of attention to crypto, beginning to make investments at such an opportune time that Zhu was once continuously credited (which is to mention, he took credit score) for calling the ground of the cycle. In later years, it gave the impression of brilliance to many impressionable crypto noobs — or even trade insiders — who adopted Zhu and Davies on Twitter. However the timing may have simply been good fortune; in spite of everything, 3 Arrows was once on the lookout for a brand new racket.

With cryptocurrencies buying and selling on exchanges all over the world, the company’s revel in with arbitrage got here in to hand immediately. One well-known buying and selling technique was once referred to as the “kimchee top class” — it concerned purchasing bitcoin in, say, the U.S. or China and promoting it at the next worth in South Korea, the place the exchanges had been extra tightly regulated, leading to upper costs. At the moment, profitable industry setups like this had been abundant and successful. They had been the bread and butter of 3 Arrows Capital, which advised traders it practiced low-risk methods designed to earn a living in each bullish and bearish instances.

Every other crypto arbitrage may contain purchasing bitcoin at its present (or “spot”) worth whilst promoting bitcoin futures, or vice versa, in an effort to harvest a worth top class. “The Fund’s funding function is to succeed in constant marketplace impartial returns whilst protecting capital,” 3AC’s respectable paperwork learn. Making an investment in some way that comes to a restricted drawback it doesn’t matter what the wider marketplace is doing is, after all, referred to as “hedging” (the place hedge price range get their title). However hedged methods generally tend to spin off essentially the most cash when completed at scale, so 3 Arrows started borrowing cash and striking it to paintings. If all went effectively, it might earn money that greater than coated the hobby it owed at the mortgage. Then it could do it far and wide once more, proceeding to develop its pool of investments, which might permit it to borrow even bigger sums.

Past heavy borrowing, the company’s expansion technique trusted some other scheme: construction a lot of social-media clout for the 2 founders. In crypto, the one social-media platform that counts is Twitter. Many key figures in what has change into a world trade are nameless or pseudo-anonymous Twitter accounts with goofy cool animated film profile photographs. In an unregulated area with out legacy establishments and with world markets buying and selling 24/7, Crypto Twitter is the middle of the sector, the clearinghouse for the scoop and perspectives that transfer markets.

Zhu — and to a lesser extent Davies — earned his means into the elite higher tier of Crypto Twitter. In line with buddies, Zhu had a mindful plan to change into a “Twitter famous person”: It entailed tweeting so much, pandering to the crypto lots with outrageously bullish prognostications, racking up an enormous collection of fans, and, in flip, turning into an apex predator on Crypto Twitter, profiting on the expense of everybody else.

Zhu received his 570,000-strong following partly via selling his concept of a cryptocurrency “supercycle” — the theory of a yearslong bull marketplace for bitcoin with costs emerging effectively into the tens of millions of greenbacks in step with coin. “As crypto supercycle continues, there can be an increasing number of other people looking to larp how early they had been,” Zhu tweeted final yr. “Simplest factor that issues is what number of cash you might have now. Both you personal the % of the important thing networks you must otherwise you don’t. Being early and coffee conviction is gross tbh.” And: “Because the supercycle continues, buttsore mainstream media will check out to discuss how the early whales personal the whole thing. The richest ppl in crypto now had near-zero web value in 2019. I do know ppl who unironically say if any person had lent them $50k extra again then theyd have $500m extra now.” Zhu hammered the purpose continuously at the platform and in his appearances on crypto podcasts and video displays: Purchase, purchase, purchase now, and the supercycle will make you insanely wealthy one day.

“They used to boast that they may be able to borrow as a lot cash as they would like,” says the previous dealer who knew them in Singapore. “This was once all deliberate, guy, from the best way they established credibility to the best way the fund was once structured.”

Because it grew, 3 Arrows branched out past bitcoin right into a slew of start-up crypto initiatives and extra difficult to understand cryptocurrencies (also known as “shitcoins”). The company appeared somewhat indiscriminate about those bets, virtually as though it considered them as a charity. Previous this yr, Davies tweeted that “it doesn’t subject in particular what a VC invests in, extra fiat within the device is nice for the trade.” Says Chris Burniske, a founding spouse of VC company Placeholder, “They had been obviously spray and pray.”

Quite a lot of traders be mindful having their first sense that one thing could be off with 3 Arrows in 2019. That yr, the fund started attaining out to trade friends with what it described as an extraordinary alternative. 3AC had invested in a crypto choices substitute known as Deribit, and it was once promoting off a stake; the time period sheet set the worth of Deribit at $700 million. However some traders spotted the valuation appeared off — and came upon its exact valuation was once simply $280 million. 3 Arrows, it became out, was once making an attempt to turn a portion of its funding at a steep markup, necessarily netting the fund a huge kickback. It was once a sketchy factor to do in project capital, and it blindsided the outdoor traders, at the side of Deribit itself. Says David Fauchier, a portfolio supervisor at Nickel Virtual Asset Control who won the pitch, “Since then, I’ve mainly stayed clear of them, held them in very low regard, and not sought after to do trade with them.”

However the company was once thriving. Throughout the pandemic, because the Federal Reserve pumped cash into the financial system and the U.S. govt despatched out stimulus assessments, cryptocurrency markets rose for months on finish. By means of past due 2020, bitcoin was once up fivefold from its March lows. To many, it gave the impression of a supercycle. 3 Arrows’ major fund posted a go back of greater than 5,900 p.c, in line with its annual document. By means of the top of that yr, it was once overseeing greater than $2.6 billion in property and $1.9 billion in liabilities.

Certainly one of 3AC’s biggest positions — and one who loomed huge in its destiny — was once one of those stock-exchange-traded type of bitcoin known as GBTC (shorthand for Grayscale Bitcoin Believe). Dusting off its previous playbook of shooting earnings via arbitrage, the company collected up to $2 billion in GBTC. On the time, it was once buying and selling at a top class to common bitcoin, and 3AC was once satisfied to pocket the adaptation. On Twitter, Zhu steadily blasted out bullish value determinations of GBTC, at more than a few issues looking at it was once “savvy” or “sensible” to be purchasing it.

Zhu’s and Davies’s public personae turned into much more excessive; their tweets had been an increasing number of pompous, and social acquaintances say they didn’t trouble to cover their condescension towards buddies from the previous and no more rich contemporaries. “They have got little or no empathy towards most of the people, particularly customary commoners,” says a onetime buddy.

3 Arrows was once identified for top team of workers turnover, maximum significantly some of the buyers, who groused that they by no means won reputation for profitable trades however had been insulted as silly after they screwed up — even their wages had been garnished and their bonuses lowered. (Nonetheless, 3AC buyers had been extremely wanted within the trade; sooner than the fund’s cave in, Steve Cohen’s hedge fund, Point72, was once interviewing a staff of 3AC buyers to probably poach for its systematic buying and selling unit.)

Zhu and Davies stored the internal workings of the company cloaked in secrecy. Simplest the 2 of them may just transfer cash between positive crypto wallets, and maximum 3 Arrows staff had no thought how much cash the corporate was once managing. Even though the team of workers complained of lengthy hours, Zhu was once reluctant to rent new other people, nervous that they might “leak industry secrets and techniques,” says the buddy. In Zhu’s view, 3 Arrows was once doing any individual who labored for it a desire. “Su stated they must be paid as an alternative for providing precious studying alternatives to staff,” the buddy provides. Some trade acquaintances in Singapore described the 3AC founders as playacting characters from a Nineteen Eighties Wolf of Wall Boulevard buying and selling flooring.

Each had been now married fathers with babies, and so they had change into workout fans, figuring out up to six instances per week and happening calorie-restricted diets. Zhu chiseled himself all the way down to about 11 p.c frame fats and posted his shirtless “updates” on Twitter. On no less than one instance, a chum recollects, he known as his non-public instructor “fats.” Requested about his pressure to change into “huge,” Zhu advised an interviewer, “I used to be super-weak for many of my existence. After COVID, I were given a private instructor. I were given two children, so it’s identical to get up, play together with your children, move to paintings, move to the fitness center, come again, put them to sleep. Shitpost in between.”

Even though no longer rather billionaires but, Zhu and Davies started treating themselves to one of the luxuries of the superrich. In September 2020, Zhu bought a $20 million mansion, identified in Singapore as a “good-class bungalow,” underneath his spouse’s title. The next yr, he purchased some other one in his daughter’s title for $35 million. (Pals say that Davies ultimately upgraded to a GCB too, after turning into a citizen of Singapore, however that the home was once nonetheless underneath renovation and he hadn’t but moved in.)

In individual, despite the fact that, Zhu was once nonetheless an introvert who wasn’t large on small communicate. Davies was once the outspoken one within the company’s trade dealings in addition to socially. Some acquaintances who had first encountered the pair on Twitter discovered them strangely understated in individual. Davies had a hipster vibe. “He has heavy disdain for a large number of mainstream, standard stuff,” says a onetime buddy. When he turned into rich, Davies went to a couple hassle to buy and customise a Toyota Century, the unique style of limo drivers in Japan. It’s a simple-looking automobile however prices about up to a Lamborghini. “He was once very proud it was once the one Jap taxi in Singapore,” says some other buddy.

Whilst Zhu and Davies grew acquainted with their new wealth, 3 Arrows persevered to be a large funnel for borrowed capital. A lending increase had taken dangle of the crypto trade, as DeFi (brief for “decentralized finance”) initiatives presented depositors a lot upper rates of interest than they may get at conventional banks. 3 Arrows would, via its “borrowing table,” take custody of cryptocurrency that belonged to staff, buddies, and different wealthy folks. When lenders requested 3 Arrows to position up collateral, it continuously driven again. As a substitute, it presented to pay an rate of interest of 10 p.c or extra, upper than any competitor was once turning in. As a result of its “gold same old” recognition, as one dealer put it, some lenders didn’t ask for audited monetary statements or any paperwork in any respect. Even huge, well-capitalized, professionally run crypto firms had been lending huge sums of cash uncollateralized to 3AC, amongst them Voyager, which was once in the long run driven into chapter 11.

For different traders, 3 Arrows’ urge for food for money was once some other warning call. In early 2021, a fund known as Warbler Capital, controlled via a 29-year-old Chicago local, was once looking to lift $20 million for a technique that in large part concerned outsourcing its capital to 3AC. Matt Walsh, a co-founder of crypto-focused Fort Island Ventures, couldn’t perceive why a multibillion-dollar fund like 3 Arrows would trouble with onboarding this sort of somewhat tiny increment of cash; it appeared determined. “I used to be sitting there scratching my head,” Walsh recollects. “It began to position up some alarm bells. Perhaps those guys had been bancrupt.”

The difficulty turns out to have began in earnest final yr, and 3 Arrows’ large wager on GBTC was once the nub of it. Simply because the company reaped the rewards when there was once a top class, it felt the ache when GBTC started buying and selling at a cut price to bitcoin. GBTC’s top class were a results of the preliminary area of expertise of the product — it was once a strategy to personal bitcoin to your eTrade account with no need to care for crypto exchanges and esoteric wallets. As extra other people piled into the industry and new possible choices emerged, that top class disappeared — then went detrimental. However quite a lot of sensible marketplace individuals had noticed that coming. “All arbitrages die after some extent,” says a dealer and previous colleague of Zhu’s.

Davies was once conscious about the danger this posed to 3 Arrows, and on a September 2020 episode of a podcast produced via Fort Island, he admitted he anticipated the industry would fade. However sooner than the display aired, Davies asked that the phase be edited out; the company obliged. Unwinding the location was once reasonably difficult — 3 Arrows’ GBTC stocks had been locked up for 6 months at a time — however Zhu and Davies had a window to get out someday that fall. And but they didn’t.

“They’d plentiful alternative to get out with a graze however no longer blow themselves up,” says Fauchier. “I didn’t suppose they might be silly sufficient to be doing this with their very own cash. I don’t know what possessed them. This was once clearly a kind of trades you wish to have to be the primary one in, and also you desperately don’t need to be the final one out.” Colleagues now say 3 Arrows hung in its GBTC place as it was once making a bet the SEC would approve GBTC’s long-anticipated conversion to an exchange-traded fund, making it a lot more liquid and tradable and most probably erasing the bitcoin worth mismatch. (In June, the SEC rejected GBTC’s utility.)

By means of the spring of 2021, GBTC had fallen beneath the worth of its bitcoins, and 3 Arrows was once now shedding on what was once most probably its greatest industry. Nonetheless, crypto loved a bull run that lasted into April, with bitcoin hitting a document above $60,000 and dogecoin, a cryptocurrency began as a comic story, rocketing off on an irrational Elon Musk–boosted rally. Zhu was once bullish on dogecoin too. Experiences put 3AC’s property at some $10 billion on the time, mentioning Nansen (despite the fact that Nansen’s CEO now clarifies that a lot of the sum was once most probably borrowed).

On reflection, 3 Arrows turns out to have suffered a fateful loss later that summer season — if of the human selection, somewhat than the monetary one. In August, two of the fund’s minority companions, who had been founded in Hong Kong and automatically labored between 80 and 100 hours per week managing a lot of 3AC’s operations, concurrently retired. That left the majority in their paintings to Davies, 3 Arrows’ leader menace officer, who gave the impression to take a extra laid-back option to browsing out for the company’s drawback. “I believe their menace control was once significantly better sooner than,” says the previous buddy.

Round that point, there have been indicators that 3 Arrows was once hitting a money crunch. When lenders requested for collateral for the fund’s margin trades, it continuously got here again pledging its fairness in Deribit — a personal corporate — as an alternative of an simply salable asset like bitcoin. Such illiquid property aren’t splendid collateral. However there was once some other snag: 3 Arrows owned the Deribit stake with different traders, who refused to log out on the use of their stocks as collateral. 3AC, it appears, was once making an attempt to pledge property it didn’t have the rights to — and was once attempting to take action many times, providing the similar stocks to more than a few establishments, in particular after bitcoin began falling in past due 2021. The company turns out to have promised the similar bite of locked-up GBTC to a number of lenders as effectively. “We suspect that 3 Arrows tried to pledge some items of collateral to many of us directly,” says Bankman-Fried, the CEO of FTX. “I might be beautiful stunned if that was once all the extent of misrepresentations right here; that might be a gorgeous bizarre accident. I strongly suspect that they made extra.”

Endure markets in crypto generally tend to make any stock-market motion seem like kid’s play. The crashes are so serious that insiders name it “crypto iciness,” and the season can final years. That’s the place 3 Arrows Capital discovered itself via the center of January 2022, and it was once poorly provided to climate it. The GBTC place ate an ever-larger hollow in 3AC’s stability sheet, and far of its capital was once tied up in limited stocks in smaller crypto initiatives. Different arbitrage alternatives had dried up. In reaction, 3 Arrows turns out to have made up our minds to ramp up the riskiness of its investments in hopes of scoring large and getting the company again on a cast footing. “What made them exchange was once simply overreaching for returns,” says a significant lending govt. “They had been most certainly like, ‘What if we simply move lengthy?’ ”

In February, 3 Arrows took one among its greatest swings but: It put $200 million right into a buzzy token known as luna, which was once based via a brash, alluring South Korean developer and Stanford dropout named Do Kwon, with whom Davies and Zhu were placing out in Singapore.

Round the similar time, Zhu and Davies had been planning to desert Singapore. They’d already moved one of the fund’s felony infrastructure to the British Virgin Islands, and in April, 3 Arrows introduced it could transfer its headquarters to Dubai. That very same month, buddies say, Zhu and Davies bought two villas for more or less $30 million mixed, one subsequent to the opposite on Dubai’s Crystal Lagoon in District One, a artifical aquamarine oasis bigger than some other on the earth. Appearing pictures of the side-by-side mansions, Zhu advised buddies he had bought his new seven-bedroom assets — a 17,000-square-foot compound that appears like a castle with hedge-lined fences and enforcing Roman columns — from the consul of Azerbaijan.

Then in early Might, luna collapsed to close 0, wiping out greater than $40 billion in marketplace cap in a question of days. Its price was once tied to an related stablecoin known as terraUSD. When terraUSD didn’t handle its greenback peg, each currencies collapsed. 3 Arrows’ holdings in luna, as soon as more or less part one thousand million greenbacks, had been value simplest $604, in line with a Singapore-based investor named Herbert Sim who was once monitoring 3AC’s wallets. Because the demise spiral spread out, Scott Odell, a lending govt at Blockchain.com, reached out to the company to test in in regards to the dimension of its luna hit; in spite of everything, the mortgage settlement stipulated that 3 Arrows notify the corporate if it skilled an total drawdown of no less than 4 p.c. “Used to be no longer that massive as a part of portfolio holdings anyway,” 3AC’s peak dealer, Edward Zhao, wrote again, in line with messages made public via Blockchain.com. A couple of hours later, Odell knowledgeable Zhao that it could wish to name again a good portion of its $270 million mortgage and would take fee in greenbacks or stablecoins. Zhao gave the impression stuck off guard. “Yo … uhh … hmm,” he spoke back of their non-public chat.

The following day, Odell reached out to Davies at once, who tersely reassured him that the whole thing was once wonderful. He despatched Blockchain.com a straight forward, one-sentence letter without a watermark, announcing that the company had $2.387 billion underneath control. In the meantime, 3 Arrows was once making identical representations to no less than part a dozen lenders. Blockchain.com is “now unsure that this web asset price remark was once correct,” in line with its affidavit, which was once integrated in a 1,157-page file launched via 3AC’s liquidators.

Relatively than back off, a couple of days later Davies threatened to “boycott” Blockchain.com if it known as again 3AC’s loans. “As soon as that took place, we knew one thing was once incorrect,” says Lane Kasselman, leader trade officer of Blockchain.com. Throughout the 3 Arrows place of business, the temper had modified. Zhu and Davies used to carry common pitch conferences on Zoom, however that month, they stopped appearing up, then managers stopped scheduling them altogether, in line with a former worker.

In past due Might, Zhu despatched out a tweet that can as effectively be his epitaph: “Supercycle worth thesis was once regrettably incorrect.” Nonetheless, he and Davies performed it cool as they known as up reputedly each and every rich crypto investor they knew, asking to borrow huge amounts of bitcoin and providing the similar hefty rates of interest the company at all times had. “They had been obviously pumping their prowess as a crypto hedge fund once they already knew they had been in hassle,” says any person with regards to one of the vital greatest lenders. Actually, 3 Arrows was once scrounging for price range simply to pay its different lenders again. “It was once robbing Peter to pay Paul,” says Fort Island’s Walsh. In the midst of June, a month after luna’s cave in, Davies advised Charles McGarraugh, leader technique officer at Blockchain.com, that he was once looking to get a 5,000 bitcoin mortgage — then value about $125 million — from Genesis to present to but some other lender to steer clear of liquidating its positions.

In follow, despite the fact that, this sort of monetary mess has a tendency to create quite a lot of promoting via everybody concerned to boost money to be able to keep solvent. 3 Arrows’ place was once so huge that it successfully started to tank the wider crypto markets: All of the scrambling to promote and meet margin calls, via 3AC itself and different panicky traders, in flip driven costs down decrease, making a vicious cycle. The declines prompt additional declines as lenders demanded much more collateral and bought positions when 3AC and others couldn’t publish it, sending bitcoin and its friends towards multi-year lows. The crash generated headlines all over the world as the full price of the crypto markets made its means beneath $1 trillion from a height of $3 trillion in past due 2021. McGarraugh says Davies advised him that “if the crypto marketplace persevered to say no, 3AC would no longer be ok.” That was once the final time any individual at Blockchain.com spoke to Davies. After that, he and Zhu stopped answering their lenders, companions, and buddies.

Rumors that the company was once collapsing seized Twitter, additional fueling the bigger crypto sell-off. On June 14, Zhu in spite of everything stated the difficulty: “We’re within the technique of speaking with related events and completely dedicated to running this out,” he tweeted. A couple of days later, Davies gave an interview to The Wall Boulevard Magazine during which he famous he and Zhu had been nonetheless “believers in crypto” however admitted, “The terra-luna scenario stuck us very a lot off guard.”

Zhu began looking to eliminate no less than one among his good-class bungalows; on the similar time, the company began shifting its cash round. On June 14, the similar day Zhu posted his tweet, 3AC despatched just about $32 million in stablecoins to a crypto pockets belonging to an affiliated shell corporate within the Cayman Islands. “It was once unclear the place the ones price range due to this fact went,” the liquidators wrote of their affidavit. However there’s a running concept. In 3 Arrows’ ultimate days, the companions reached out to each and every rich crypto whale they knew to borrow extra bitcoin, and peak crypto executives and traders — from the U.S. to the Caribbean to Europe to Singapore — consider 3AC discovered keen lenders of final hotel amongst organized-crime figures. Owing such characters huge sums of cash may just provide an explanation for why Zhu and Davies have long past into hiding. Those also are the forms of lenders you wish to have to make complete sooner than any individual else, however you could have to path the cash in the course of the Caymans. Says the previous dealer and 3AC trade spouse, “They paid the Mafia again,” including, “In the event you birth borrowing from those guys, you will have to be in point of fact determined.”

After the cave in, executives at crypto exchanges started evaluating notes. They had been stunned to be told that 3 Arrows had no brief positions, which is to mention it had stopped hedging — the very factor it had maintained was once the cornerstone of its technique. “It’s really easy to try this,” says the key lending govt, “with none of the buying and selling desks understanding you’re doing that.” Buyers and substitute executives now estimate that, via the top, 3AC was once leveraged round 3 times its property, however some suspect it might be magnitudes extra.

3 Arrows turns out to have stored the entire cash in commingled accounts — unbeknownst to the homeowners of the ones price range — taking from each and every pot to pay again lenders. “They had been most certainly managing this entire factor on an Excel sheet,” says Walsh. That supposed that once 3AC omitted margin calls and ghosted lenders in mid-June, the ones lenders, together with FTX and Genesis, liquidated their accounts, no longer understanding they had been additionally promoting property that belonged to 3AC’s companions and purchasers. (This appears to be what took place with 8 Blocks Capital, which complained on Twitter in June that $1 million from its buying and selling account with 3AC had disappeared.)

After the company’s buyers stopped responding to messages, lenders attempted calling, emailing, and messaging them on each and every platform, even pinging their buddies and preventing via their houses sooner than liquidating their collateral. Some peered in the course of the door of 3AC’s Singapore place of business, the place weeks of mail was once piled up at the flooring. Individuals who had considered Zhu and Davies as shut buddies, and had lent them cash — even $200,000 or extra — simply weeks previous with out listening to any point out of misery on the fund, felt outraged and betrayed. “They’re without a doubt sociopaths,” says one former buddy. “The numbers they had been reporting in Might had been very, very incorrect,” says Kasselman. “We firmly consider they dedicated fraud. There’s no different strategy to state it — that’s fraud, they lied.” Genesis International Buying and selling had lent 3 Arrows essentially the most of any lender and has filed a $1.2 billion declare. Others had lent them billions extra, a lot of it in bitcoin and ethereum. Thus far, liquidators have recovered simplest $40 million in property. “It turned into transparent that they had been bancrupt however had been proceeding to borrow, which in point of fact simply looks as if a vintage Ponzi scheme,” says Kasselman. “Comparisons between them and Bernie Madoff aren’t some distance off.”

When 3 Arrows Capital filed for Bankruptcy 15 chapter, the method for international firms, on July 1 within the Southern District of New York, it was once roughly a formality. However the submitting itself did include some surprises. Whilst collectors rushed to record their claims, 3AC’s founders had already overwhelmed them to it: The primary individual in line was once Zhu himself, who on June 26 filed a declare for $5 million, at the side of Davies’s spouse, Kelly Kaili Chen, who claimed she had lent the fund with regards to $66 million. The one documentation they needed to again up their claims had been straight forward, self-attested statements that didn’t specify when the loans were made or the aim of the price range. “That’s a complete Mickey Mouse form of operation,” says Walsh. Whilst insiders had been ignorant of Chen’s involvement within the company, they consider she will have to had been performing on Davies’s behalf; her title seems on more than a few company entities, most probably for tax causes. Each Zhu’s and Davies’s moms have additionally filed claims, in line with other people accustomed to the location. (Zhu later advised Bloomberg Information, “They’re gonna, you recognize, say that I absconded price range all through the final duration, the place I if truth be told put extra of my non-public a reimbursement in.”)

Because the company filed for chapter, the liquidators hadn’t been in a position to get in contact with Zhu and Davies till simply sooner than press time and nonetheless don’t know the place they’re, in line with other people accustomed to the location. Their attorneys stated the co-founders have won demise threats. On an ungainly July 8 Zoom name, individuals with Zhu’s and Davies’s usernames logged on with their cameras off, refusing to unmute themselves even because the pair of British Virgin Islands liquidators fired dozens of questions at their avatars.

The government also are taking a better have a look at 3 Arrows. The Financial Authority of Singapore — the rustic’s similar of the SEC — is investigating whether or not 3AC, which it already reprimanded for offering “false or deceptive” knowledge, dedicated “additional breaches” of its rules. Within the U.S., SEC enforcement lawyers are actually being copied on all 3 Arrows court docket filings.

On July 21, Zhu and Davies gave an interview with Bloomberg “from an undisclosed location.” The interview is unusual for a number of causes — Zhu protests the headlines about his free-spending way of life via noting that he motorcycles to paintings, doesn’t move clubbing, and “simplest has two houses in Singapore” — but in addition for the reason that companions blame 3AC’s implosion on their failure to foresee that the crypto marketplace may just move down. Neither says the phrase supercycle, however the reference is apparent sufficient. “We located ourselves for one of those marketplace that didn’t finally end up taking place,” Zhu says, whilst Davies provides, “Within the nice instances we did the most efficient. After which within the unhealthy instances we misplaced essentially the most.”

The pair additionally advised Bloomberg they had been making plans to visit Dubai “quickly.” Their buddies say they’re already there. The oasis gives a selected benefit, say attorneys: The rustic has no extradition treaty with Singapore or the U.S.

Supply By means of https://nymag.com/intelligencer/article/three-arrows-capital-kyle-davies-su-zhu-crash.html